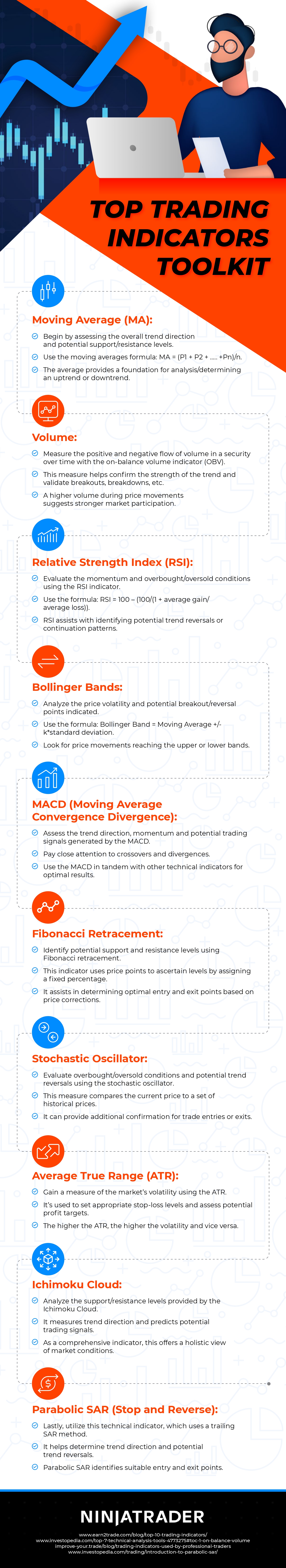

Day traders can gain significant advantages by using trading indicators like the Parabolic Stop and Reverse (SAR) to spot possible shifts in trends and set trailing stop-loss points accurately. SAR features distinctive ‘dots’ that appear above or below price movements, adapting dynamically to the current market direction.

By keeping an eye on these dots, traders get actionable insights into how strong a trend is and when it might be losing steam. By adding SAR to their trading toolkit, day traders can improve their ability to catch price swings during the day and manage risks more effectively.

For more details on how SAR helps traders avoid risks while entering and exiting the market, please see the information found in the infographic shared alongside this post.

Top Trading Indicators Toolkit, provided by NinjaTrader, a provider of index futures contracts